Are you retirement ready?

Retirement is coming whether you like it or not, figuring out how much you may need when you retire requires planning and thought, but having an idea of what sort of lifestyle you would like at that stage of your life can be a good starting point.

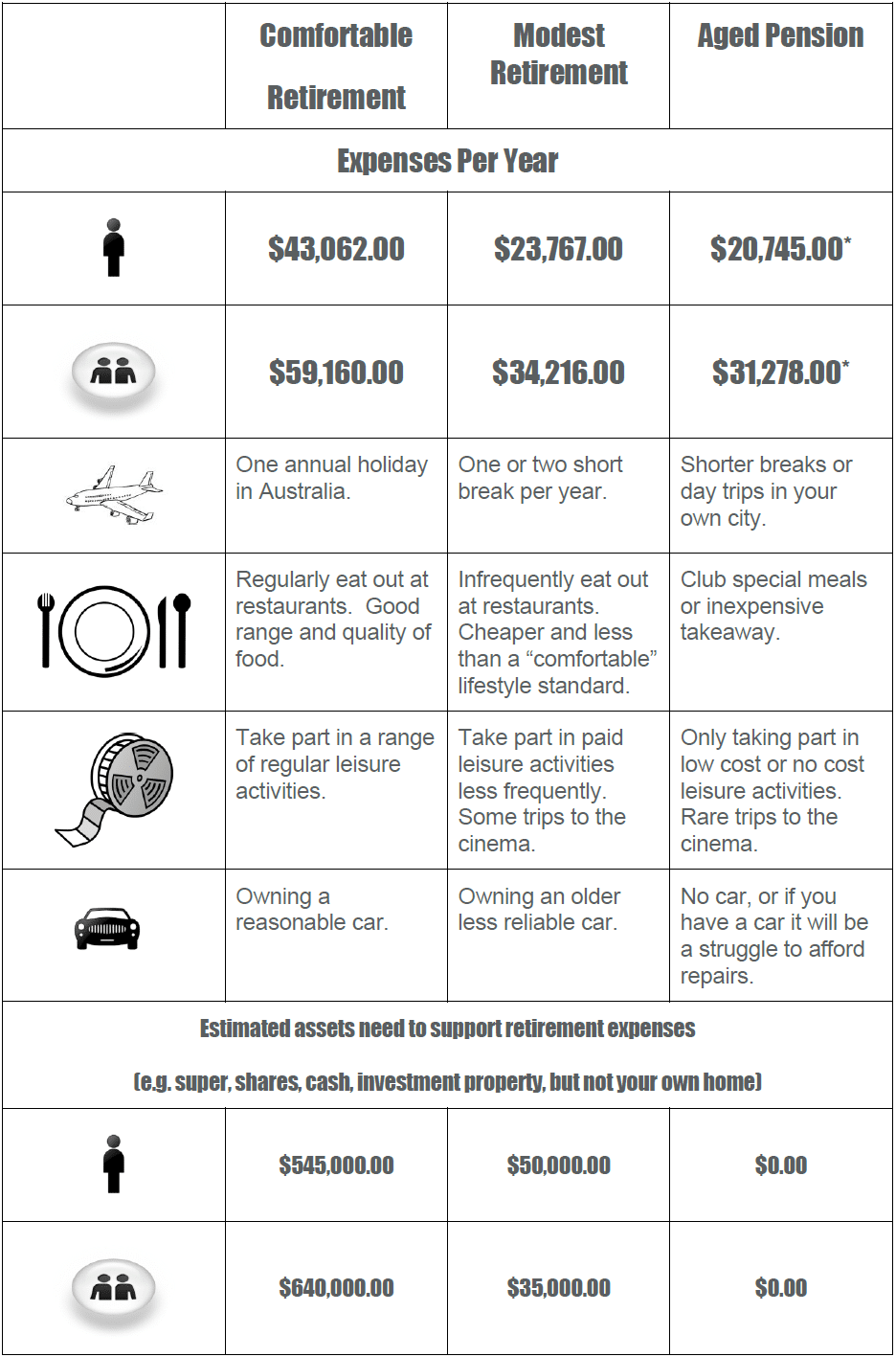

The Association of Superannuation Funds of Australia’s (ASFA) Retirement Standard benchmarks the annual budget you may need for both a ‘comfortable’ and ‘modest’ retirement lifestyle. You can compare the table below with your own lifestyle now, which is an indicator of how you may want to live in retirement.

Retirement lifestyle guide

Another way to estimate how much money you will need in retirement to live on, is to assume you need 67% (two thirds) of your annual income you are earning before you retire to maintain the same standard of living in retirement. This estimate is only suitable for high income earners. This information is from ASIC. www.moneysmart.gov.au

How the right financial advice can help you?

Before you retire your planner can help you to:

- Transition to retirement from work

- Grow your super

- Build or adjust your investment portfolio

- Access government benefits

- Save for children or grandchildren.

After retirement, your planner can assist with:

- Growing your super and income

- Adjusting or restructuring assets and investments

- Pensions and social security

- Inheritance and gifting money to children

- Aged care advice.

The earlier you start planning for your retirement, the more likely you are going to have the required funds to support the lifestyle you want.

Preparing for retirement, superannuation planning, pensions and tax can appear daunting when you are young and many people put off planning for the future because it can all seem a bit too confusing.

If you are thinking you might have around 10 years left of your working life, then there are some steps you can take now to get your retirement savings on track.

There are three main questions to ask before you begin:

- How much money will you need in retirement?

- How much are you prepared to contribute now?

- How long are you prepared to keep working?

Once you have given some consideration to the major questions, you can start thinking about the details.

How long will retirement last?

Many people expect they will be living into their 80s and if you retire at 65 and live to 85, that’s 20 years you must support yourself without earning an income from employment.

At the moment, you might qualify for the government age pension at 65. This will depend on your circumstances, which include whether you’re a member of a couple, what assets you own, how much income you still earn and whether you are living in Australia.

However, this age requirement is changing from 2017 and by 2023, when the starting point will be 67 years.

The amount that the age pension provides might not be enough to support the lifestyle you would like, so superannuation savings and investments might be the way to manage to do more.

What is a comfortable retirement, the Association of Superannuation Funds Australia (ASFA) describes a ‘comfortable’ retirement as one where you can renovate your house, buy a new car and eat out regularly, as well as take an annual holiday. It calculates that a single person would need around $43,000 a year in annual income, or $59,000 for a couple, to afford this lifestyle in retirement.

What will retirement look like?

When you are not working, you might have plans to travel, take up hobbies, or spend more time with family and friends.

There’s several things to consider as you head towards retirement, including:

- Where you want to live?

- How much travelling you want to do?

- What your day-to-day activities might be?

What about expenses?

You might like to reflect on what your expenses would be when you stop working, and consider the following possibilities:

- Will you have to pay off any debts or mortgage?

- Will you need to pay rent where you decide to live?

- What health considerations do you have?

- Are there likely to be ongoing costs for any medical conditions?

- Do you want to leave an inheritance?

The sooner you can start planning for what you want and how you would like to live then the sooner you can put some saving and investment strategies in place.

Declan Hanratty – Managing Director

M: 0409 089 456 F: 03 9416 1916 ABN: 19 880 907 430 POSTAL: PO Box 1551 COLLINGWOOD Victoria 3066 MFAA Membership No. 50217 Australian Credit Licence No. 383120 Credit Ombudsman Service No. 412201